Rewards and Loyalty

Let's Talk Checking Accounts

Sep 21, 2023

Courtney May

Let’s talk checking accounts.

The fintech space grew enormously over the last decade.

Nowadays, with the U.S. banking sector being a wide variety of financial institutions, each with unique strengths and value propositions, it’s difficult to know how your offered services compare to your competitors.

Amid the expansiveness, one common product offering stands out - the checking account, a staple of personal finance.

Below we’ll help answer the following questions that are looming amongst legacy Financial Institutions (FIs):

How does your Checking Account offering stack up to competitor FIs?

How can Community FIs and Credit Unions gain relevance to younger generations?

What kind of benefits or perks do other checking account providers offer and how much do they charge the account holder?

Checking Account Offerings: From Basic to Value-Added

Checking accounts forms the backbone of customer relationships, serving as the gateway for numerous other banking services. The basic checking account, with its standard features, serves the day-to-day financial needs of customers.

However, there's a growing trend towards benefits-oriented checking accounts. These value-adding accounts not only serve as a differentiator but also offer the potential for increased customer engagement and revenue generation.

How commonplace is the benefits-oriented checking account these days?

To be a leader in the financial services space, it's crucial to understand the competitive advantages of checking account offerings and strategize accordingly. Community FIs, with their deep community ties, can leverage personalized services and local economic support. Credit unions, with their member-centric approach, can capitalize on lower fees and better rates. Neo banks, with their digital-first model, are focusing on competitive pricing and seamless digital experiences.

While community FIs and credit unions offer benefits such as yield, insurance, cash-back, and local discounts, they can be perceived as less competitive in comparison to the offerings of neo-banks.

The most common benefits found in the data collection were APY, which varied from 0.1% to 4%, different types of insurance services, cash-back, travel discounts and points, and discounts at local restaurants or shops.

Specific programs like Kasasa Cash Back and BaZing add further value to CFI offerings. Kasasa Cash Back, a free checking account that offers interest rates, ATM fee refunds, and online banking without a minimum balance requirement, adds considerable value for customers. Similarly, a BaZing checking account offers benefits like phone protection, local discounts, and a health savings card.

In the modern banking landscape, neo-banks, or digital challenger banks, are increasingly gaining prominence. They appeal to younger generations such as millennials and Gen Z, thanks to their digital-first approach, competitive pricing due to lower overheads, and innovative, targeted services. This poses a significant threat to traditional banking institutions, particularly community financial institutions and credit unions.

How can Community Financial Institutions stay relevant?

Despite their advantages, neo-banks face their own set of challenges. Building customer trust, ensuring cybersecurity, achieving profitability, and navigating complex regulatory landscapes are among these hurdles. This scenario presents a unique opportunity for community banks and credit unions, which already enjoy a significant level of trust and connection with their customers due to their local presence and longstanding relationships.

Adapting to the digital age, CFIs are expanding their digital banking services and forming strategic partnerships with fintech companies to expedite their digital transformation. This approach helps them leverage their local focus and customer trust while integrating the benefits of digital banking.

However, attracting customers, especially the younger generation, remains a challenge. The perception persists that CFIs lack the necessary innovative products that can compete with those of mega-banks or neo-banks. This gap presents an opportunity for CFIs to innovate in product offerings and marketing, thus enhancing their brand and making a positive impact on their communities.

What are other FIs charging for checking accounts?

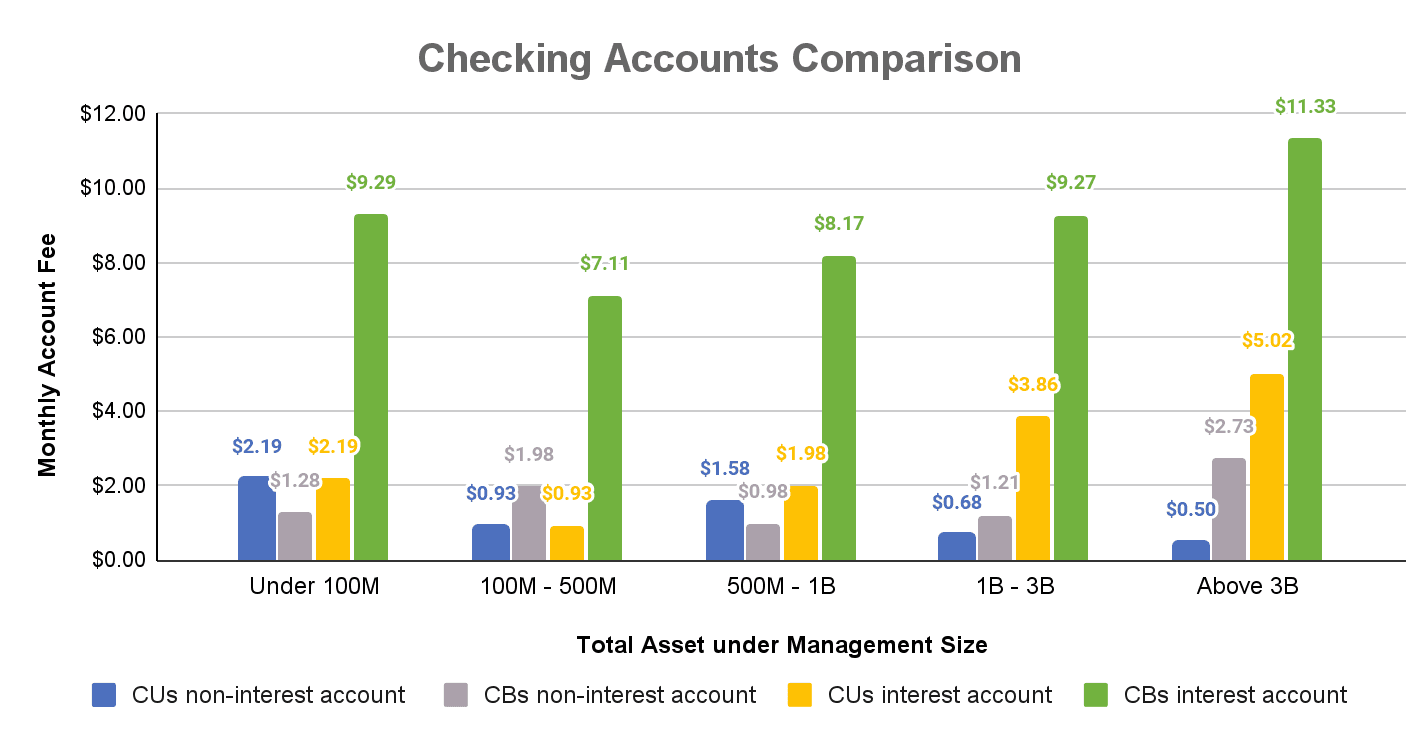

The pricing and benefits associated with checking accounts vary significantly across different types of financial institutions, different offerings, by state, or by FI size.

Our analysis shows distinct pricing patterns across different AUM sizes. For non-interest accounts, community banks with under $100M AUM have lower monthly charges than credit unions in the same category.

The biggest monthly difference between community FIs and credit unions when looking at non-rewards accounts is for AUM above $3b, where the average basic account at a credit union costs $0.5 per month, while it costs around $2.73 at community FIs. If we look at the whole sample, the average cost for basic accounts at credit unions is $1.11, while for community banks, the results showed an overall average of $2.80 per month.

It is important to mention that most of the community FIs waive stated monthly chargers for basic accounts if required minimum balances are maintained or if customers/members are opting to receive eStatements. Minimum balance requirements fluctuate greatly- starting from as little as $10 and getting up to thousands of dollars.

Benefits-Oriented Checking Accounts

Taking this pricing into account, FIs can see how account holders will pay for benefit-oriented accounts. The demand is there and the pricing data proves that.

On top of this, there is a dire need for local financial institutions to gain relevance for younger generations of account holders that are drawn to neo-banks which allow them to earn various types of benefits in their checking accounts.

Bits of Stock can help you integrate and price a Stock Rewards Checking Account to your suite of services that will bring in and retain the rising generation of checking account users.

By integrating this product into upgraded checking accounts, customers can receive fractional shares with their transactions, providing them a lower-risk opportunity to invest in the stock market. The fractional shares, which are given as rewards on transactions or if other requirements set by the CFIs are maintained, do not impact the customer's funds, making it an attractive option for a wide range of customers. This can be an opportunity for anyone, no matter what background, age, or financial situation to learn about the stock market without risking their own money.