OMB's Story

OMB bank shared a vision to make investing more accessible for all through everyday habits. Their objective was to stand out on a national scale among increasing competition in the banking sector. With an emphasis on increasing card engagement and loyalty, their existing cash back rewards checking was not up to the challenge!

OMB's Story

OMB bank shared a vision to make investing more accessible for all through everyday habits. Their objective was to stand out on a national scale among increasing competition in the banking sector. With an emphasis on increasing card engagement and loyalty, their existing cash back rewards checking was not up to the challenge!

OMB's Story

OMB bank shared a vision to make investing more accessible for all through everyday habits. Their objective was to stand out on a national scale among increasing competition in the banking sector. With an emphasis on increasing card engagement and loyalty, their existing cash back rewards checking was not up to the challenge!

Objective

Increasing card engagement and loyalty

Drive Subscription Fee Income

Increase revenue through new subscriptions and higher customer activity.

Enhance Card Engagement

Encourage customers to engage with their OMB cards more frequently and make it part of their everyday spending habits.

Boost Subscriptions and Retention

Attract new users and retain existing ones by offering compelling, value-added services.

Objective

Increasing card engagement and loyalty

Drive Subscription Fee Income

Increase revenue through new subscriptions and higher customer activity.

Enhance Card Engagement

Encourage customers to engage with their OMB cards more frequently and make it part of their everyday spending habits.

Boost Subscriptions and Retention

Attract new users and retain existing ones by offering compelling, value-added services.

Objective

Increasing card engagement and loyalty

Drive Subscription Fee Income

Increase revenue through new subscriptions and higher customer activity.

Enhance Card Engagement

Encourage customers to engage with their OMB cards more frequently and make it part of their everyday spending habits.

Boost Subscriptions and Retention

Attract new users and retain existing ones by offering compelling, value-added services.

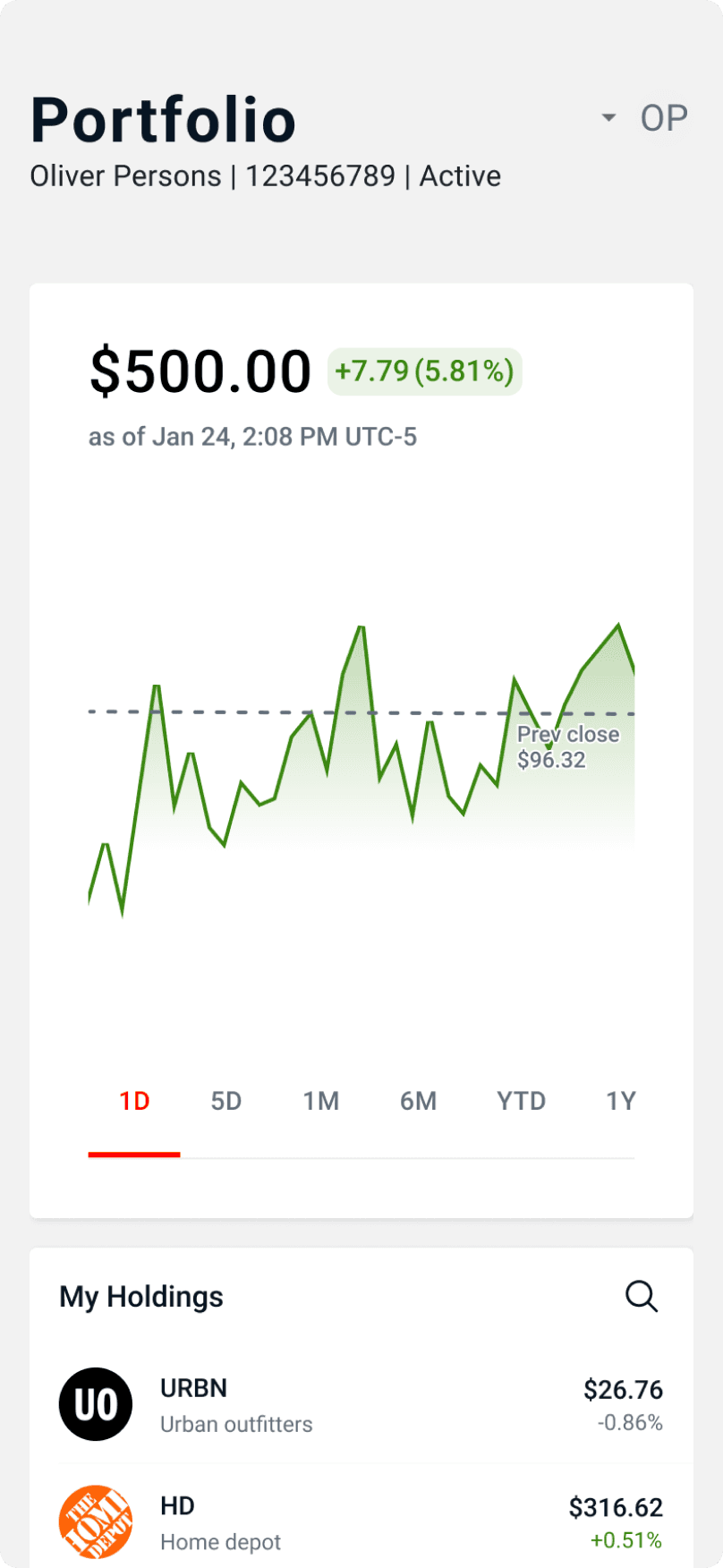

Solution

With OMB Bank we launched a Stock Rewards Checking at $5.99 per Month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

With OMB Bank we launched a Stock Rewards Checking at $5.99 per Month. Their members had the ability to generate rewards with any of 10 pre-approved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 2.5% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

Full Brokerage

Customers had access to commission free trading stocks and ETF, including fractional shares as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they prefered.

Customers had access to commission free trading stocks and ETF's, including fractional shares for as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they preferred.

Solution

With OMB Bank we launched a Stock Rewards Checking at $5.99 per Month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 2.5% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

Full Brokerage

Customers had access to commission free trading stocks and ETF, including fractional shares as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they prefered.

Solution

With OMB Bank we launched a Stock Rewards Checking at $5.99 per Month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 2.5% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

Full Brokerage

Customers had access to commission free trading stocks and ETF, including fractional shares as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they prefered.

Result

We increased engagement 16%. The launch of OMB Bank Stock Rewards Checking, picked up press by American Banker, Yahoo Finance, and many other national and local publications, helping OMB bank get national exposure.

+15%

Monthly Spending

+12%

Number of Swipes

$16.00

$19.04

Monthly Revenue per Member

Based on averages over the period of March to September 2024

Result

We increased engagement 16%. The launch of OMB Bank Stock Rewards Checking, picked up press by American Banker, Yahoo Finance, and many other national and local publications, helping OMB bank get national exposure.

+15%

Monthly Spending

+12%

Number of Swipes

$16.00

Monthly Revenue per Member

Based on averages over the period of March to September 2024

Result

We increased engagement 16%. The launch of OMB Bank Stock Rewards Checking, picked up press by American Banker, Yahoo Finance, and many other national and local publications, helping OMB bank get national exposure.

+15%

Monthly Spending

+12%

Number of Swipes

$16.00

Monthly Revenue per Member

Based on averages over the period of March to September 2024

A word from OMB

"The partnership with Bits of Stock is a major differentiator for us as a Community Bank. When it comes to banking, you see the same things over and over again. We are really breaking the mold from that. It helped us expand nationally and make a bigger splash by driving card spending revenue. This is our breakthrough to appealing to Gen Z and Millennials tangibly. This is truly cutting-edge for our community."

Steve Bishop, CIO and President of OMBx

A word from OMB

"The partnership with Bits of Stock is a major differentiator for us as a Community Bank. When it comes to banking, you see the same things over and over again. We are really breaking the mold from that. It helped us expand nationally and make a bigger splash by driving card spending revenue. This is our breakthrough to appealing to Gen Z and Millennials tangibly. This is truly cutting-edge for our community."

Steve Bishop, CIO and President of OMBx

A word from OMB

"The partnership with Bits of Stock is a major differentiator for us as a Community Bank. When it comes to banking, you see the same things over and over again. We are really breaking the mold from that. It helped us expand nationally and make a bigger splash by driving card spending revenue. This is our breakthrough to appealing to Gen Z and Millennials tangibly. This is truly cutting-edge for our community."

Steve Bishop, CIO and President of OMBx

Check out our other customer stories

Check out our other customer stories

Check out our other customer stories

Get in touch

Get in touch

Get in touch