Strata's Story

Strata Credit Union aimed to increase financial empowerment for members. Their objective was to attract new deposits and younger members, while driving subscription fee revenue.

Strata's Story

Strata Credit Union aimed to increase financial empowerment for members. Their objective was to attract new deposits and younger members, while driving subscription fee revenue.

Strata's Story

Strata Credit Union aimed to increase financial empowerment for members. Their objective was to attract new deposits and younger members, while driving subscription fee revenue.

Objective

Empower younger members and drive subscriptions

Increase Investment Accessibility

Allow members to participate in the stock market by earning fractional stock rewards on debit card purchases.

Boost member engagement

Differentiate Strata’s checking accounts to increase transaction frequency and engagement.

Promote wealth building

Empower members to grow their wealth, making financial wellness an integral part of daily banking.

Objective

Empower younger members and drive subscriptions

Increase Investment Accessibility

Allow members to participate in the stock market by earning fractional stock rewards on debit card purchases.

Boost member engagement

Differentiate Strata’s checking accounts to increase transaction frequency and engagement.

Promote wealth building

Empower members to grow their wealth, making financial wellness an integral part of daily banking.

Objective

Empower younger members and drive subscriptions

Increase Investment Accessibility

Allow members to participate in the stock market by earning fractional stock rewards on debit card purchases.

Boost member engagement

Differentiate Strata’s checking accounts to increase transaction frequency and engagement.

Promote wealth building

Empower members to grow their wealth, making financial wellness an integral part of daily banking.

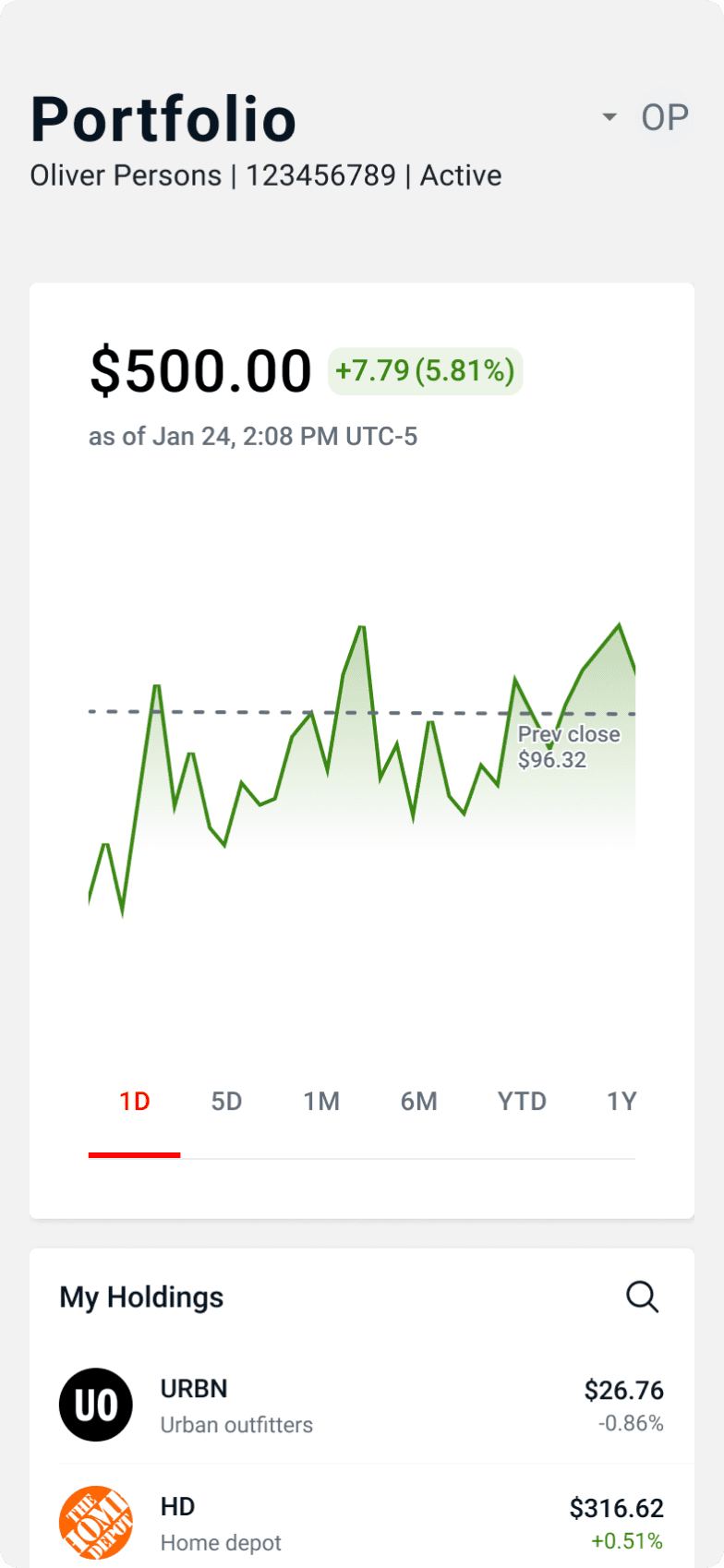

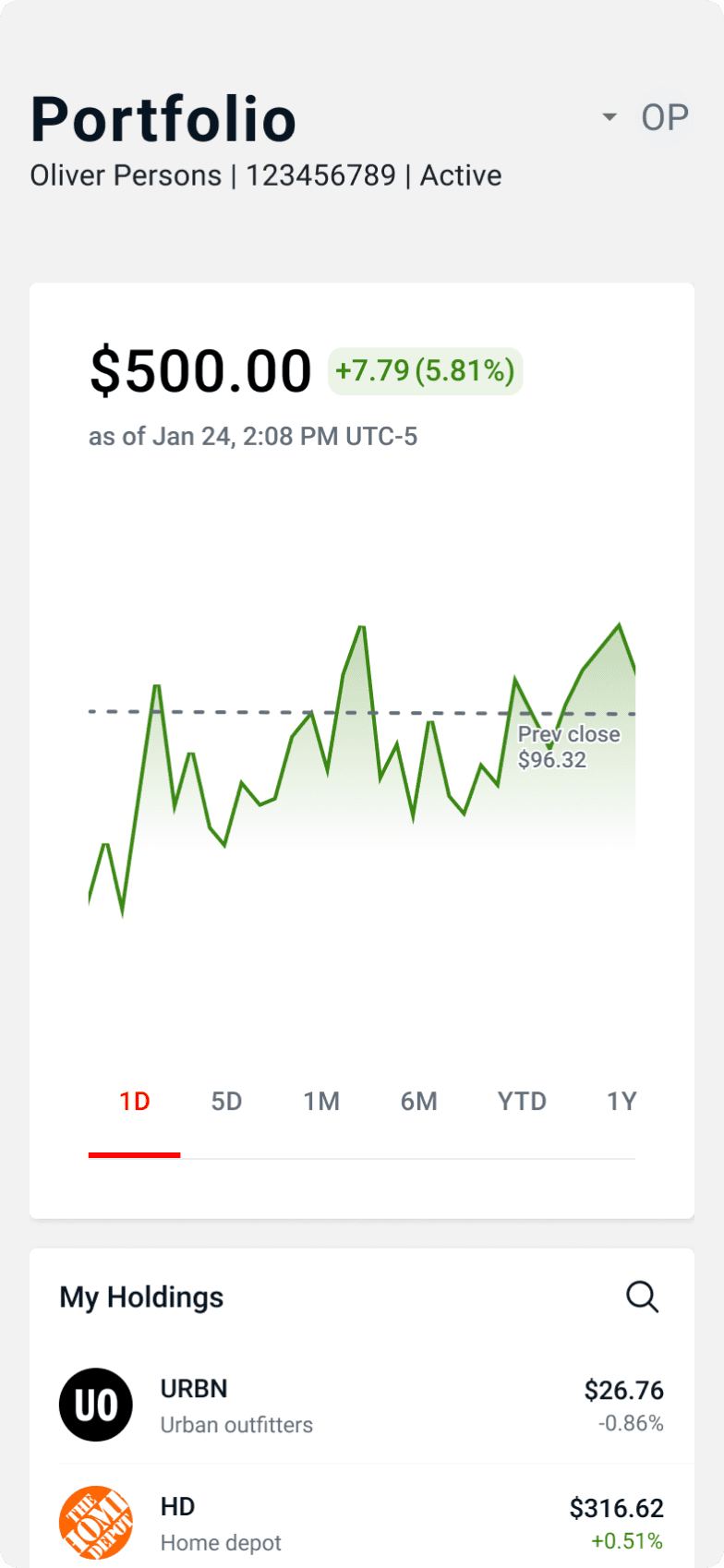

Solution

With Strata we set up a Stock Rewards Checking Account for $3.00/month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 1% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

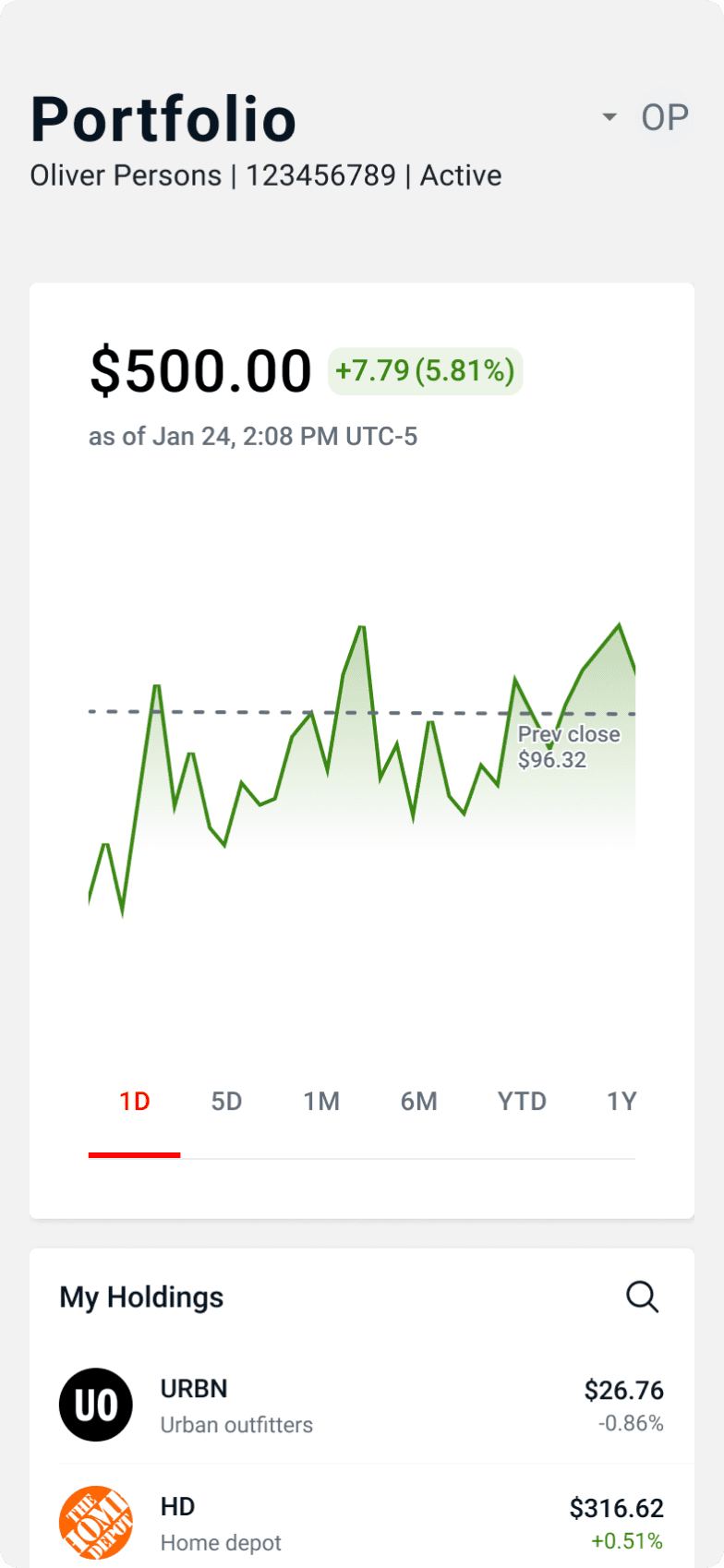

Full Brokerage

Customers had access to commission free trading stocks and ETF's, including fractional shares far as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they preferred.

Customers had access to commission free trading stocks and ETF's, including fractional shares as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they preferred.

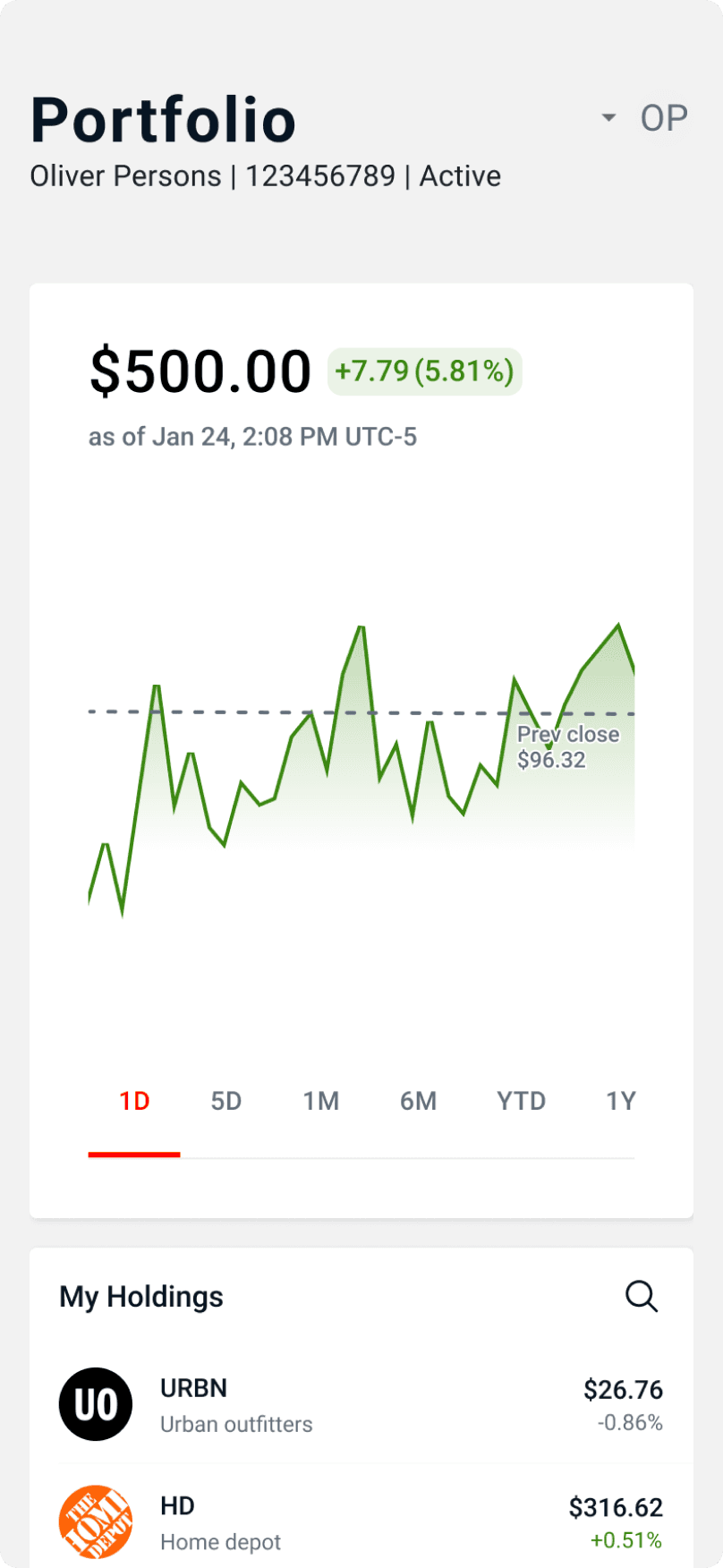

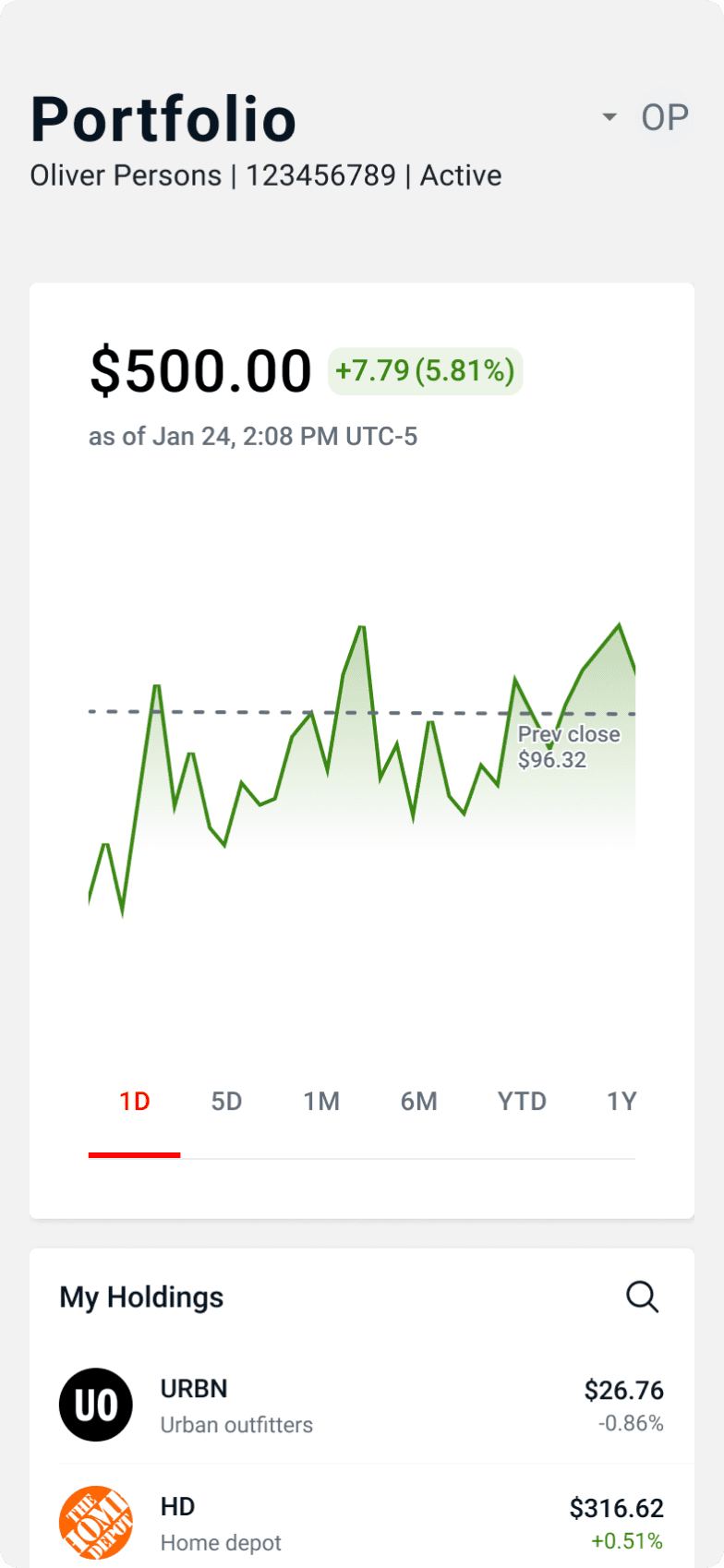

Solution

With Strata we set up a Stock Rewards Checking Account for $3.00/month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 1% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

Full Brokerage

Customers had access to commission free trading stocks and ETF's, including fractional shares far as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they preferred.

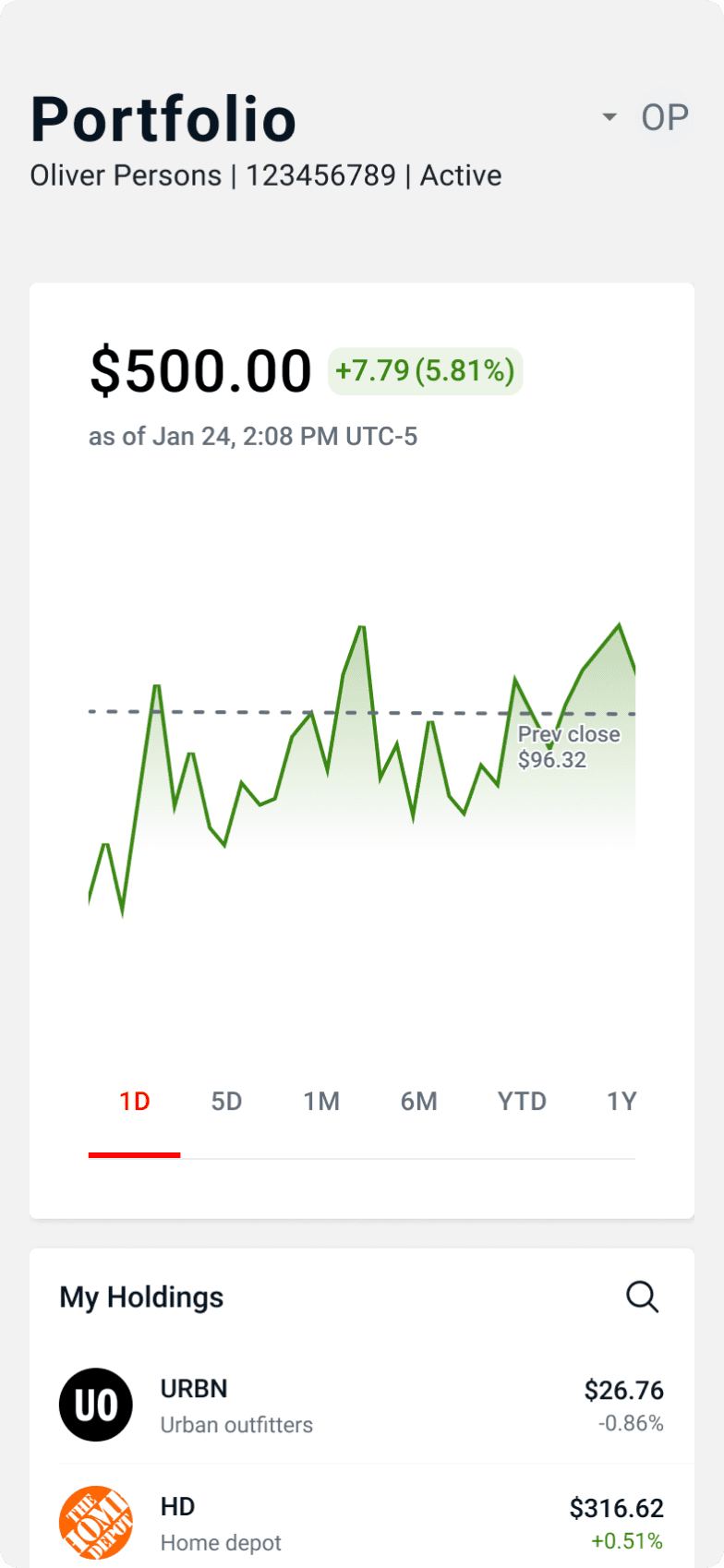

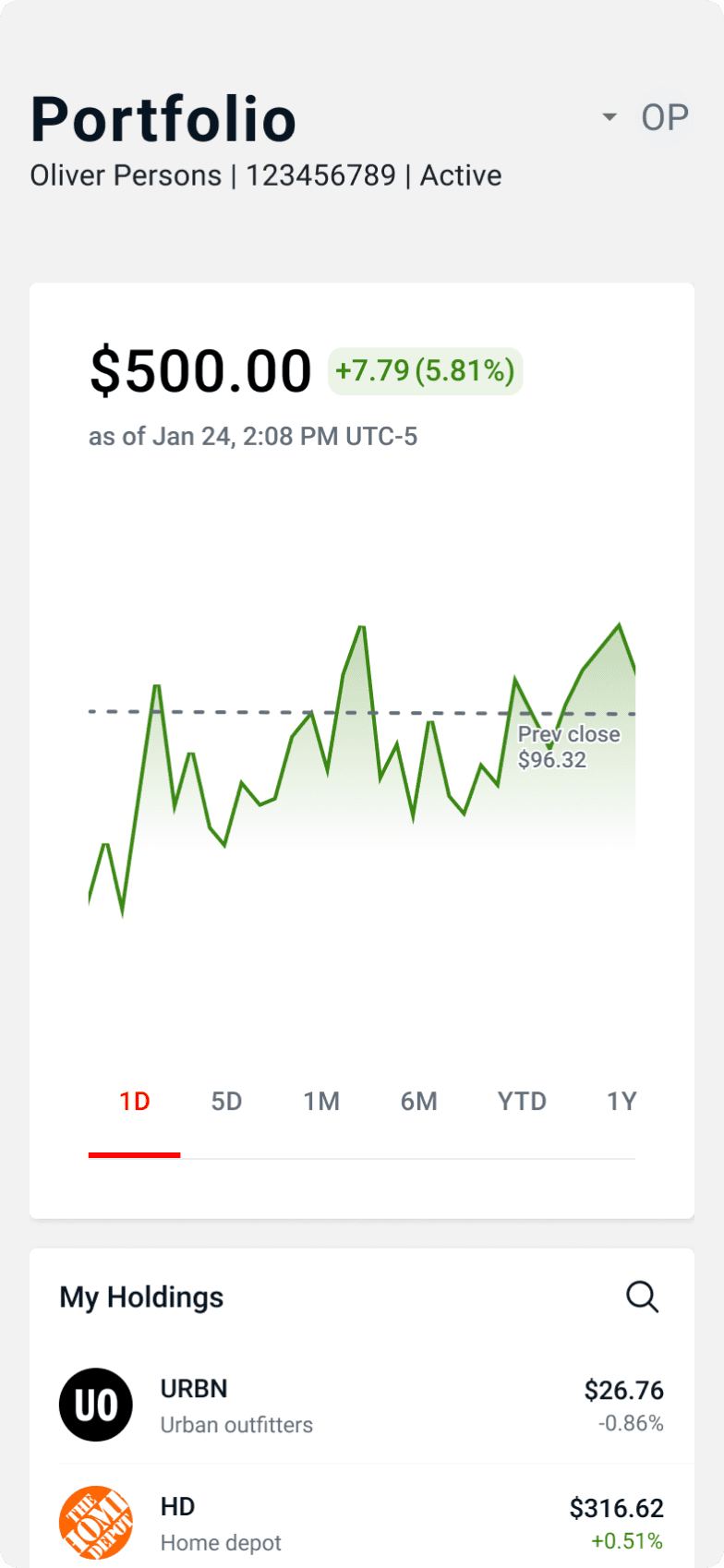

Solution

With Strata we set up a Stock Rewards Checking Account for $3.00/month. Their members had the ability to generate rewards with any of 10 pre-aproved stocks, with redeemable thresholds of $5.00.

Stock Rewards

Customers earned 1% on all purchases, limited to $15.00 per month to a stock of their choosing.

Thresholds

Customers needed to log in to their account to “redeem” their rewards once they accumulated more than $5.00 in rewards.

Full Brokerage

Customers had access to commission free trading stocks and ETF's, including fractional shares far as little as $0.01. Once a stock was rewarded and redeemed it entered their brokerage account, through which they could manage their portfolio however they preferred.

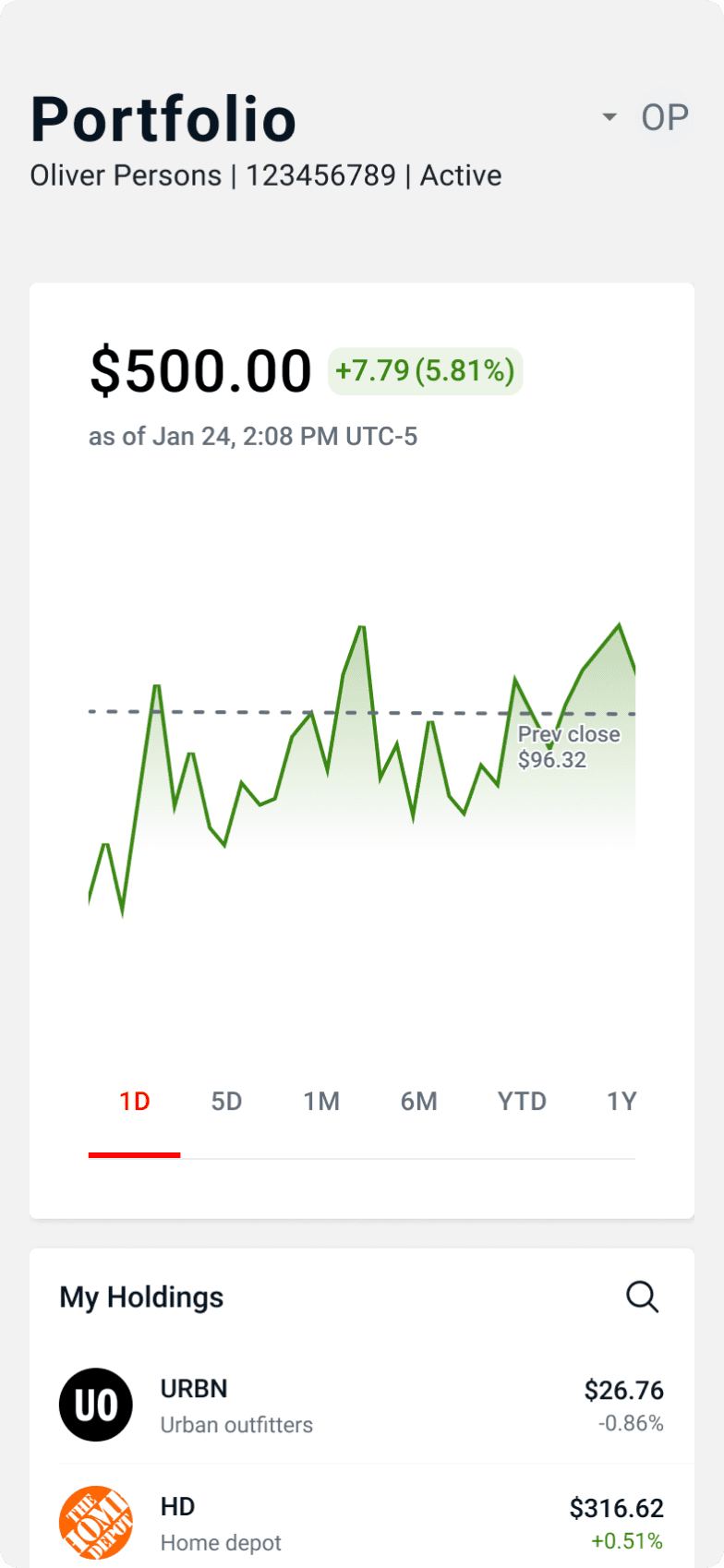

Result

We converted 20% of new digital account openings to fee accounts and increased averages swipes from 14 to over 30 swipes per month, well above the industry standard.

+27%

Monthly Spending

+22%

MoM Number of Swipes

$24.37

Monthly Revenue per Customer

Based on averages over June to October 2024

Result

We converted 20% of new digital account openings to fee accounts and increased averages swipes from 14 to over 30 swipes per month, well above the industry standard.

+27%

Monthly Spending

+22%

MoM Number of Swipes

$24.37

Monthly Revenue per Customer

Based on averages over June to October 2024

Result

We converted 20% of new digital account openings to fee accounts and increased averages swipes from 14 to over 30 swipes per month, well above the industry standard.

+27%

Monthly Spending

+22%

MoM Number of Swipes

$24.37

Monthly Revenue per Customer

Based on averages over June to October 2024

A word from Strata

"Partnering with Bits of Stock to launch our Stock Rewards Checking Account has been transformative for Strata Credit Union. Their innovative solution has helped us financially empower our member base, generate new subscription revenue, and differentiate ourselves in our community. Thanks to Bits of Stock's white-glove support and expertise, our new account now represents over 20% of monthly openings and has garnered local press attention. I highly recommend Bits of Stock to any financial institution looking to innovate and provide real value to their members."

Brandon Ivie, CEO of Strata Credit Union

A word from Strata

"Partnering with Bits of Stock to launch our Stock Rewards Checking Account has been transformative for Strata Credit Union. Their innovative solution has helped us financially empower our member base, generate new subscription revenue, and differentiate ourselves in our community. Thanks to Bits of Stock's white-glove support and expertise, our new account now represents over 20% of monthly openings and has garnered local press attention. I highly recommend Bits of Stock to any financial institution looking to innovate and provide real value to their members."

Brandon Ivie, CEO of Strata Credit Union

A word from Strata

"Partnering with Bits of Stock to launch our Stock Rewards Checking Account has been transformative for Strata Credit Union. Their innovative solution has helped us financially empower our member base, generate new subscription revenue, and differentiate ourselves in our community. Thanks to Bits of Stock's white-glove support and expertise, our new account now represents over 20% of monthly openings and has garnered local press attention. I highly recommend Bits of Stock to any financial institution looking to innovate and provide real value to their members."

Brandon Ivie, CEO of Strata Credit Union

Check out our other customer stories

Check out our other customer stories

Check out our other customer stories

Get in touch

Get in touch

Get in touch